Is your business getting the best pricing on your carrier contracts? Many companies think they have the best possible rates because the carrier representative assures this. Let Refund Retriever save your company 15% to 20% with a FedEx or UPS carrier contract negotiation.

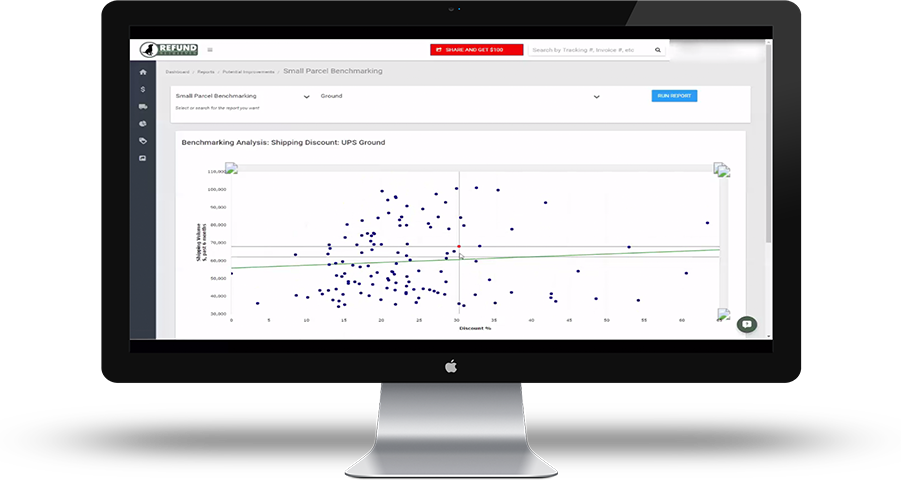

Carrier contracts are difficult to understand and overly complicated on purpose. They contain multiple pricing tiers with different discounts for different weights and zones. You are probably an expert in your industry but not in shipping agreements and pricing. Refund Retriever can provide the reports, analytics, and understanding to cut through the agreement language and allow your business to achieve best-in-class shipping rates.