Many shippers contact us with questions about shipping insurance. To start, FedEx does not offer shipping insurance. FedEx offers additional declared value. So let’s get a better idea of the rules for FedEx declared value.

Estimated reading time: 4 minutes

FedEx Declared Value Cost for 2025

When you use FedEx declared value, the cost is based on the item’s value. Coverage is free for the first $100 of value, so you pay no additional fees. Many shippers are not aware of this. If the declared value is even one penny over $100, the cost is a minimum of $4.50 up to a value of $300.

Also, if the declared value is over $300, the cost will increase by $1.50 per $100 of the declared value. For example, if your shipment is valued at $301 to $399, the total cost of the FedEx declared value fee will be $6.00. The price is the same for a package valued at $305 or $395.

| FedEx Declared Value Cost | 2025 Cost | 2026 Cost |

| Value from $0 to $100 | Free | Free |

| Value from $100.01 to $300 | $4.50 | $4.95 |

| Value over $300, charge for each $100 | $1.50 per $100 declared | $1.65 per $100 declared |

Declared Value is NOT shipping insurance.

The FedEx service guide explicitly states that FedEx DOES NOT provide insurance coverage. They encourage shippers to transfer the risk to an insurance carrier, in fact. FedEx can require that shipments with a declared value of $500 or more may not be released without a signature, even when the release is authorized. The declared value cannot be greater than the declared value for customs.

From the FedEx Service Guide: You may transfer this risk to an insurance carrier of your choice by purchasing an insurance policy. Contact an insurance agent or broker if you desire insurance coverage. WE DO NOT PROVIDE INSURANCE COVERAGE OF ANY KIND.

FedEx Maximum Declared Values

- 1 Day (Overnight), 2 Day, or 3 Day (Express Saver): The maximum declared value per shipment is $50,000.

- FedEx Ground and FedEx SameDay: the maximum value per shipment is $2,000.

- First Overnight, FedEx 1Day, 2Day, or 3Day Freight: the maximum declared value per shipment is $50,000.

- The maximum declared value for any FedEx Envelope or FedEx Pak is $500.

- Goods with a value (actual or declared) exceeding $500 should not be shipped in a FedEx Envelope or Pak.

FedEx Declared Value $1,000 Limitations.

Individual packages with the following items are limited to a maximum declared value of $1,000:

- Artwork, paintings, drawings, vases, limited-edition prints, fine art, statuary, sculpture, and collectors’ items

- Any film, photographic images, negatives, chromes, and slides

- Any commodity inherently susceptible to damage, or the market value is variable or difficult to ascertain

- Antiques, furniture, tableware, and glassware

- Plasma screens

- Jewelry or Furs

- Precious metals (gold, silver, or platinum)

- Stocks, bonds, cash letters, or cash equivalents (stamps, traveler’s checks, lottery tickets, money orders, gift cards)

- Collector’s items (coins, stamps, sports cards, souvenirs, and memorabilia)

- Guitars and other musical instruments – over 20 years old and customized

- Scale models and prototypes

Declared Value does not mean full price

Regardless of the shipment’s value, FedEx’s liability for loss or damage will not surpass the repair cost, depreciated value, or replacement cost, whichever is less. FedEx will pay out the smallest amount, even if that means more work for you.

Also, the declared value does not cover any loss from loss of profit or income. Even if FedEx is fully aware that a delay or damage will result in a loss of profit.

Deadline for Claims

- Express – FedEx must receive notice of a claim due to damage, delay, or shortage within 21 calendar days after delivery of the shipment.

- Ground – The sender or recipient must notify FedEx Ground no later than 60 days after delivery.

FedEx Declared Value Conclusion

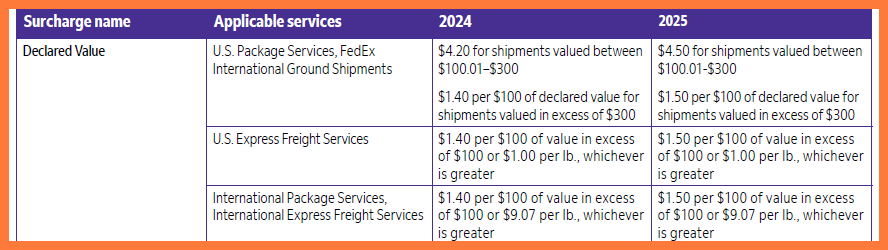

Stay tuned for our next post in which we will cover UPS declared value fees, then look at some ways to lower these costs. UPS also does not provide shipping insurance, to be clear. How much do you spend on declared value fees? Refund Retriever’s reports can reveal shipping intelligence your company needs. Our declared value report will provide you with the amount spent and a complete list of all the tracking numbers with this surcharge.