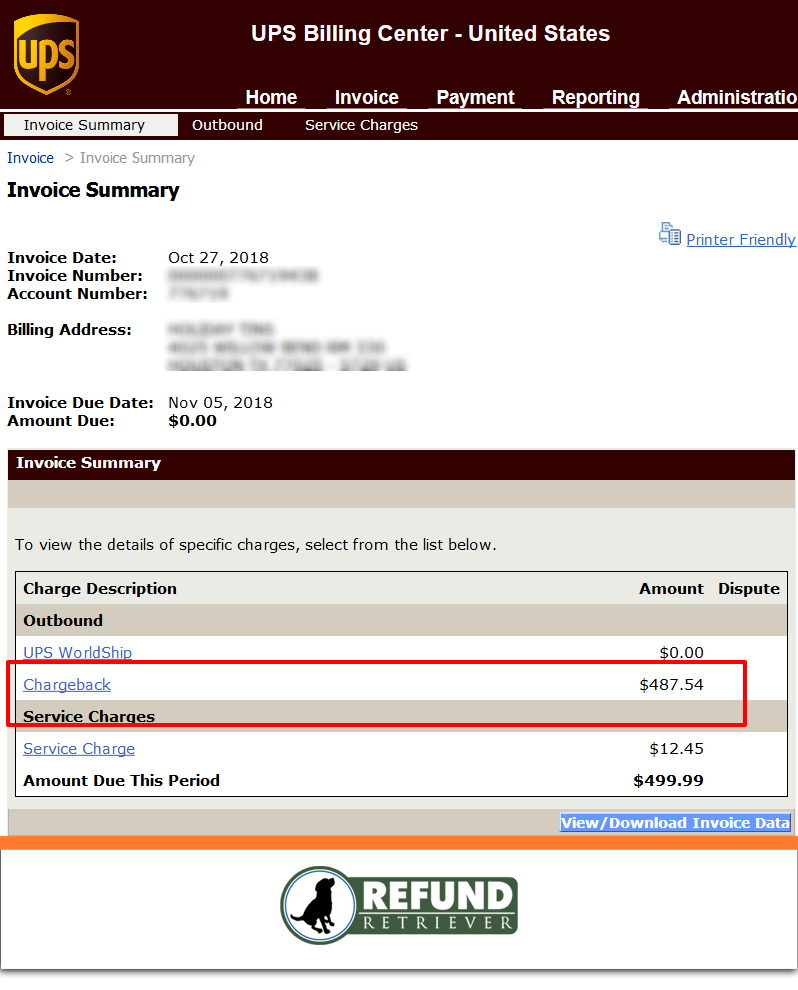

UPS Chargebacks for consignee billed shipments are rarely understood by shippers. Unfortunately, we had a conversation with a UPS shipper who had a nasty surprise on his recent UPS invoice. Upon reviewing the invoice, we found nearly $500 in charges in the invoice category labeled “Chargeback.” There were four tracking numbers shipped five months in the past that were rebilled to the shipper.

In the event of non-payment by the consignee or third party, the original shipper will be billed

UPS Chargeback for Consignee Billing Shipments definition from UPS Service Guide

a refusal fee in addition to the shipping charges.

Upon further investigation, we found that the recipient purchased a product from our shipper and wanted the shipper to use the recipient’s account number for the UPS shipping charges. The shipper entered the correct information in the UPS system, and the charges were initially billed to the recipient. But after five months of non-payment or a possible dispute, UPS returned to the original shipper and applied these charges.

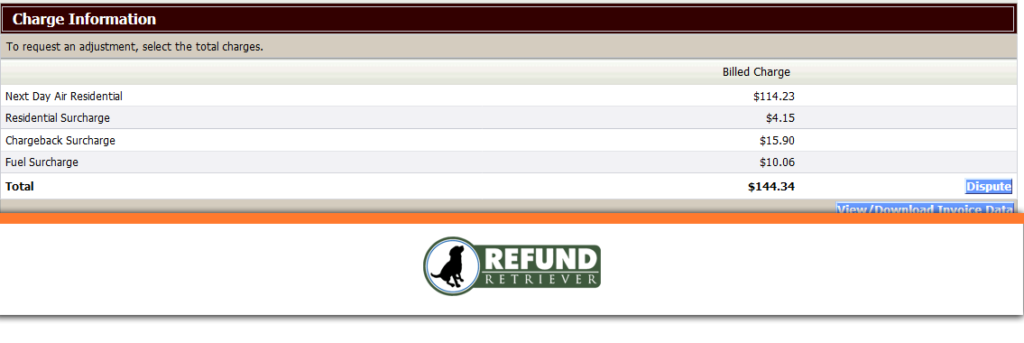

The new charges were at full price plus some additional fees. UPS did not apply the shipper’s contracted discount rates, then added a $15.90 UPS chargeback surcharge to the total of each package. So, our shipper was charged published rates plus an additional fee on four packages the recipient agreed to pay for. How does this happen? Let’s investigate more…

UPS Chargeback Fees

| Service | 2024 Cost |

| Small Package | $21.00 |

| Air Freight | $25.00 |

How can a shipper defend against these?

- Please don’t do it!

- Ask the third party to create a label online and email that to place on all the shipments necessary.

- These labels are created on their account number and are not connected to your account number.

- Watch your invoices for UPS chargebacks.

- Monitor each invoice for these chargebacks and payer rebilling.

- When you identify a potential issue, get on the phone with carrier billing and your recipient.

- Having access to a chargeback report will help highlight these charges.

- Only use the account number of established business partners.

- Be sure the account number is billable and active. Pick up the phone and call FedEx or UPS to confirm.

- Retain written confirmation to use the third party’s account number.

- In the event of a dispute by a third party, having an email confirming the approval to use that account number will help with the charges.

- Create a company chargeback policy.

- If customers insist on using their account number, create a policy with customer consent and acknowledgment.

- The policy should clearly state your option to charge the shipping fees back to the credit card in case of a chargeback or payer rebelling.

- Another good option is to keep the customer’s credit card number on file in case of a UPS chargeback.